connecticut sports betting tax rate

In Maryland there is a gambling winnings tax rate of 875. What is the tax rate for Connecticut sports betting.

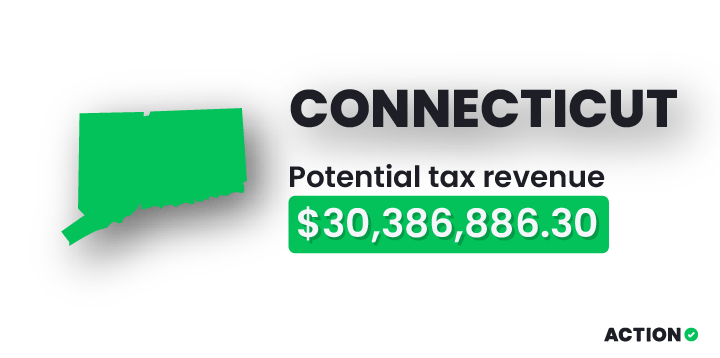

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

The lowest rate is 2 whereas the highest is just under 6 at 575.

. The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate. Three online brands were authorized. The sports betting tax rate for CT is 1375.

Thats the expected amount that will be owed when it comes tax time each year but that doesnt mean its the amount that is actually owed. Most states allow offshore sports gambling but until recently Connecticut had a prohibition in place for all online gaming. Mohegan Digital took in 123 million in wagers and paid.

The tax rate in Connecticut on sports betting and fantasy sports is 1375 of gross gaming revenue money bet minus money paid out As a state entity the Connecticut Lottery does not pay taxes on its sports betting revenue. The total amount owed for taxes on gambling winnings depends on the total amount earned by. 12000 and the winner is filing separately.

Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. 10 online 8 retail. Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues.

Thats good for an effective tax rate of 125 which matches the states bifurcated tax rates of 85 on retail betting and 1425 on mobile betting. The IRS code includes cumulative winnings from. The final vote on HB 6451 was 122 to 21 with eight people.

This rate applies equally to both the tribes and the lottery though the latter is apparently seeking to do better via its revenue-sharing. The standard amount withheld by sportsbooks to cover sports betting taxes on wins is 24. Sports betting tax rates range from as low as 675 in Iowa 84 in Michigan and 9 in South Dakota with a lot more states charging around 15 to 20 while a few like Delaware 50 Rhode Island 51 and New York 51 all charge a great bit more.

19 but getting to that point was sometimes a painstaking process. Sports betting revenue receives a tax rate of 1375. Connecticut sports betting apps pay a 1375 revenue tax.

Tax rate on sportsbook operators. Sports betting tax rate. This does not explicitly state sports betting but it.

Sports betting taxes are almost always levied as a percentage of the value of the adjusted. The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. Online casino gaming and sports betting has been live in Connecticut since Oct.

How States Tax Sports Betting Winnings. Connecticut Legal Online Sports Betting Tax Rate. How States Tax Sports Betting Winnings.

Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds. A tax rate somewhere between the 675 rate charged in Nevada and the 85 rate applied in New Jersey can be expected in Connecticut.

The lifting of this prohibition has also provided legal. 19 and the state reported that its tax coffers gained a total of 17 million in about a half-month of betting under the new system on a total of 366 million in wagers. The deal also calls for a separate 1375 tax rate on sports betting.

24000 and the winner is filing. The 1375 tax rate on gross gaming revenue in Connecticut is quite favorable for the region as New Yorks tax. Both the tribes and the Connecticut Lottery will pay the tax.

The Nutmeg State legalized sports wagering on May 19 2021 by Gov. Taxes and fees for sports betting and iGaming. Both sports betting and online gambling would be limited to those 21 and older.

That changed in 2021 when the CT state legislature passed a bill allowing for legal Connecticut sports betting across all fronts - in-person online and mobile. That is higher than the. Proceeds will go to a college fund to allow students to attend Community College for free and also to fund some smaller municipalities in the state.

Connecticut lottery can take up to 15 retail sportsbooks Bettors cannot place wagers on Connecticut college sports teams. 24 Tax Withheld. The federal tax on that bet is 025 which results in an effective tax rate of 5 percent of GGR and even more of actual revenue.

Connecticut sports betting totals Connecticut market snapshot. 13000 and the winner is filing single. States have set rules on betting including rules on taxing bets in a variety of ways.

The CT House of Representatives passed legislation regarding sports betting and online gaming in the state Thursday. Ned Lamont and launched six months later on Oct. This is in line with the national trends where the majority of states have opted for lower rates.

10 on net sports betting proceeds. Registration is allowed in any state outside Connecticut but bets can be placed only in Connecticut. The bill passed by state legislators ratified the details of the new gaming compact between tribes and the state.

CT sports betting law. The 1375 tax rate on sports betting revenue resulted in 512951 for the 20 days of wagering. Sports betting licenses are good for 10 years.

This first revenue collection for our state reinforces the process and approach by my administration when it came to ensuring our sports betting and iCasino platforms worked seamlessly for consumers Connecticut GovNed Lamont said in a statement. Online casino games online were a lot bigger than sports betting. That isnt the complete list of all gambling winnings that are taxable though.

Commonly sports betting operators have revenue known as hold of 5 percent of the handle which means that for every 100 you wager the operator takes 5 of which they must pay taxes and expenses. In fact every dollar you win gambling is taxable. 13 of first 150 million then 20.

Connecticut online sports betting took a major step forward this week after gaming bills advanced to the states House of Representatives. A 1375 tax rate on sports wagering and an 18 tax. 19000 and the winner is filing head of household.

Mohegans Agree To Sharing Sports Betting With Ct Lottery

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut

Online Gambling Connecticut Is It Legal 5 000 At Ct Gambling Sites

Connecticut Sports Betting Revenue Tracker And Market Analysis

Connecticut Icasino Sports Betting Numbers Grow

Connecticut Sports Betting Best Ct Betting Sites Apps For 2022

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

Is Online Sports Betting Legal In Connecticut

Sports Betting Online Gambling On Hold In Connecticut After Procedural Issue Takes Longer Than Expected Politics Government Journalinquirer Com

Connecticut Sports Betting Igaming Regulations Gain Legislative Approval

Connecticut Gambling Revenue Highs And Lows In February

The Big Handle How The Outcome Of The Super Bowl Could Impact Tax Revenue Connecticut Public

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Connecticut Generates 54 6m Handle In First Month Of Sports Betting

Sports Online Gambling To Start In October Ct News Junkie

Connecticut Sports Betting Apps Top Legal Sportsbooks In Ct Miami Herald

Is Online Sports Betting Legal In Connecticut

Playct Com Connecticut Could Generate As Much As 450 Million In Online Casino And Sportsbook Revenue Annually

Five Things To Know About Legalized Sports Betting In Connecticut